How Smart People Solve Their Problems And Why 90% People Ignore This!

[adrotate group="1"]

[adrotate group="29"]

[adrotate group="30"]

If You Could Fix Any Area Of Your Life What Would It Be?

Listen up, folks! We've got millions of peeps out there wrestling with life's curveballs. But here's the deal – no matter what you're going through, there's always been some wise soul who's walked that same path and found the golden ticket out!

As the legendary Will Smith once dropped some knowledge bombs, "There have been millions and gazillions of people who have lived before us and there is no new problem you can have that someone has not written the solution down in a book." And you know what? Old Willy boy's onto something. It's harmony with Joshua 1:8 from the Bible said, "This Book of the Law as it should not depart from your mouth, and you must read it in an undertone day and night, in order to observe carefully all that is written in it; for then your way will be successful and then you will act wisely."

So here's the deal, amigos – I might be wrestling with a problem you've already aced, and vice versa. Just 'cause life ain't serving you rainbows and unicorns right now, doesn't mean it's a forever deal. I mean, think about it – the average Joe spends a whopping 6 hours glued to the TV, and another 2 hours hypnotized by their cell phone, usually doing some pretty unproductive stuff (like Tik Tok dance videos, smashing buttons in video games, texting, and FaceTiming). Why not channel that time into something that'll kick your life into high gear?

So, bottom line – let's swap those screen binges for a dose of wisdom and problem-solving. Time's ticking, and we've got a world of solutions waiting in those dusty old books.

ATTENTION! The following video is provided by a 3rd party vendor. If the video is no longer available, it is because the owner of the video or Youtube removed the video from their servers. We apologize for any inconvenience.

[adrotate group="1"]

[adrotate group="29"]

[adrotate group="30"]

Most People Would Rather Complain About Their Problems Rather Than Doing Something About It

Well, strap in, folks, 'cause we've all heard that old chestnut – "history repeats itself." Yep, it's like a never-ending deja vu parade, and you know what that means? We've got a treasure trove of wisdom passed down from folks who've walked this bumpy road before us, whether they're kicking it on Earth or hanging out in the great beyond.

But here's the kicker – most folks waste precious time running away from their problems, instead of rolling up their sleeves and hunting down solutions like a boss.

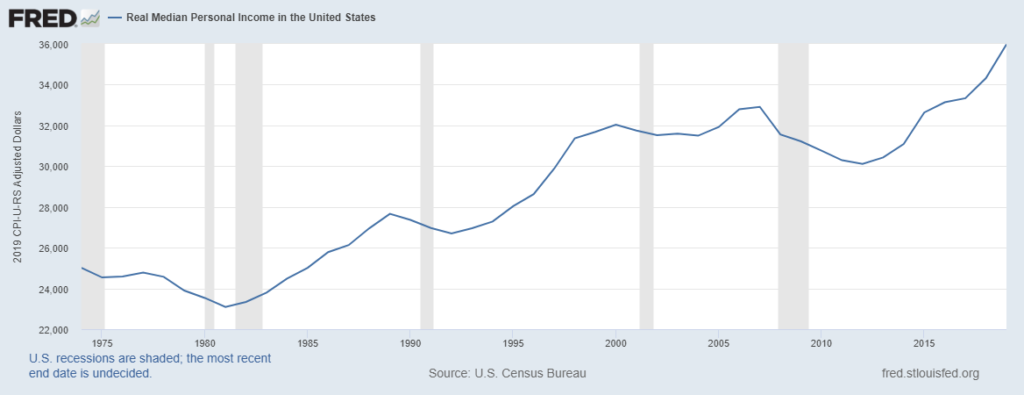

Take, for instance, the money saga. People love to whine about it, but here's the scoop – billions of our hard-earned tax dollars have gone into cracking the financial code, yet most of us just let it gather dust. The average Joe buys fewer than 2 books a year. Now, on the flip side, your average millionaire? Well, they dedicate a solid 60 minutes daily to soak in that sweet knowledge about business and finances.

Warren Buffett? That dude devours 800-1000 pages daily. Bill Gates? He's on reading vacations. Even Rick Harrison from Pawn Stars goes all-in with 4 hours a day. My first mentor dropped 90 grand on college for a shiny 30k-a-year job. But when he splurged a hundred grand on business books, courses, and seminars, he was raking in a million bucks within three years.

So here's the deal, folks – whatever life's tossing your way, instead of drowning in TV, video games, and a futile escape act, invest that time in hunting down solutions. Know thyself, and if your ears are your best pals, grab some audiobooks and programs. Listen in the car, before snoozeville, or at home sweet home.

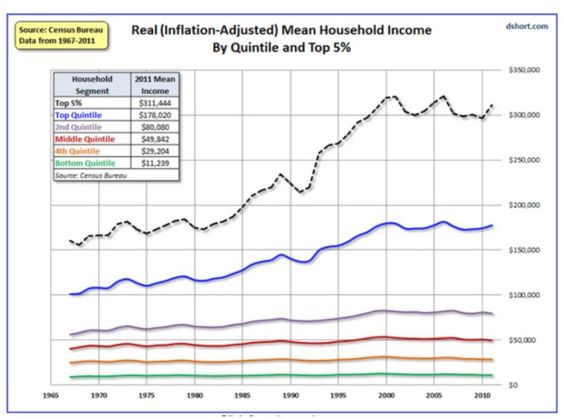

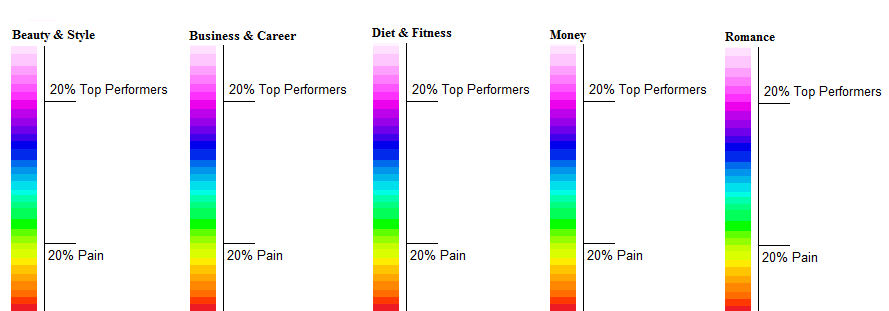

Now, check out that graph in your workbook. The bottom 20%? They only take action when pain's got them by the throat. Then you've got the 60% cruising along in "status quo" land – not thrilled but not rock bottom either.

But here's where the party's at – the top 20%, the "high performers." They're living the good life, but they ain't settling. See, the average Joe faces some major curveball every 18 months or so. So instead of twiddling their thumbs and waiting for trouble, high performers are the "proactive" bunch. They see problems from a mile away and take 'em down before they even show up.

So, where do you stand on this wild graph of life? Are you reacting or proactively owning your destiny? It's time to step up and be the hero of your own story!

[adrotate group="32"]

You Were Not Born Knowing How To Walk, Talk Or Drive A Car Were You?

These are all skills you learned when you needed them. Making money, saving money, getting in shape, even your marriage and relationships are all skills you learned when the time was right. We are each different and don't develop these skills at the same age and in some cases, we never learn them.

So no matter what issues you have in life, you should spend 60 minutes each and every day educating yourself on the subjects. However, society today wants the fast version and that's where we come in.

[adrotate group="1"]

[adrotate group="29"]

[adrotate group="30"]

Don't Leave Your Live In Someone Else's Hands

Well, well, well, look who's craving that sweet, sweet "instant gratification." Yep, we're living in an age where we want results served up on a silver platter, and we want 'em now, no sweat required. But here's the kicker – in our quest for the quick fix, we're missing out on the glorious feeling of internal gratification that comes from good old-fashioned hard work and learning the ropes.

Here's a newsflash, folks – most of us are handing the reins of our lives over to someone else. Take being sick, for example. Relying solely on your doc to fix you up? According to the American Medical Association, that's a one-way ticket to potential mistreatment, and guess what – it's one of the leading causes of DEATH! So why not take the bull by the horns and wrestle your life back into shape?

Don't just dump your health, finances, and relationships into someone else's lap. When you decide to seize control of your destiny by exploring the solutions others have discovered throughout history, that's when the real party starts. You'll be living a life that's not just productive but dripping with happiness.

[adrotate group="32"]

How To Live A Balanced Lifestyle

Well, if you're aiming for that ultimate recipe for a happy, fulfilled life, it's all about keeping things balanced, my friends. When you manage to nail a few key areas of your life and keep 'em under control, it's like magic – the rest of the pieces just fall right into place. Yours truly spends hours every single day expanding my knowledge across the board and cooking up a plan to level up.

You know, there's that old saying, "It's not what you know but who you know." But I'm here to tell you, it's more than that – it's not just "who you are, who you know," but also "what they know." My greatest senseis and mentors have handed down their wisdom, and I've whipped up a shortcut to get all the different parts of your life into harmony. So, no matter what curveballs life hurls at you, there's always a lesson to be learned – whether from the living legends or the dearly departed.

And here's the kicker, folks – I don't think anyone ever truly crosses the finish line when it comes to self-improvement. It's a lifelong adventure, and trust me, it can be one heck of an exciting ride if you let it. So here's the deal – I'm extending an invitation, folks. Join me on this epic journey of self-improvement, and together, we'll crank up the excitement to a whole new level!

[adrotate group="1"]

[adrotate group="29"]