Pay Your Bills And Earn Rewards To Finance Your Next Vacation!

[adrotate group="1"]

[adrotate group="29"]

[adrotate group="30"]

Introduction:

Every time you make a purchase with your credit card, the business you buy from incurs a fee. Moreover, when you utilize various reward cards, you, as the customer, earn cashback and reward points, which are ultimately paid for by the companies themselves. Essentially, the businesses where you use your credit card end up indirectly financing your vacations. Similar to the concept of "EXTREME COUPONING," where individuals exploit coupon programs to obtain large quantities of items for free, there are "TRAVEL HACKERS" who leverage loopholes in the credit card industry to earn complimentary trips. These tactics allow them to take advantage of the system and enjoy free travel opportunities.

Stephen Paid His Bills & Earned 170 Vacations:

Let's consider Stephen, who has accumulated an impressive 20 million credit card points, resulting in 170 complimentary flights over the past year. Among these flights, many were luxurious private jet experiences. Additionally, Stephen has enjoyed free vacations at some of the world's most prestigious resorts. To encourage more people to sign up and use their credit cards, companies offer enticing sign-on bonuses. For instance, the Chase Sapphire card provides new cardholders with 50,000 points. Each point holds an approximate value of two cents, meaning that 50,000 points can be redeemed for approximately $1,000 worth of free flights and vacations.

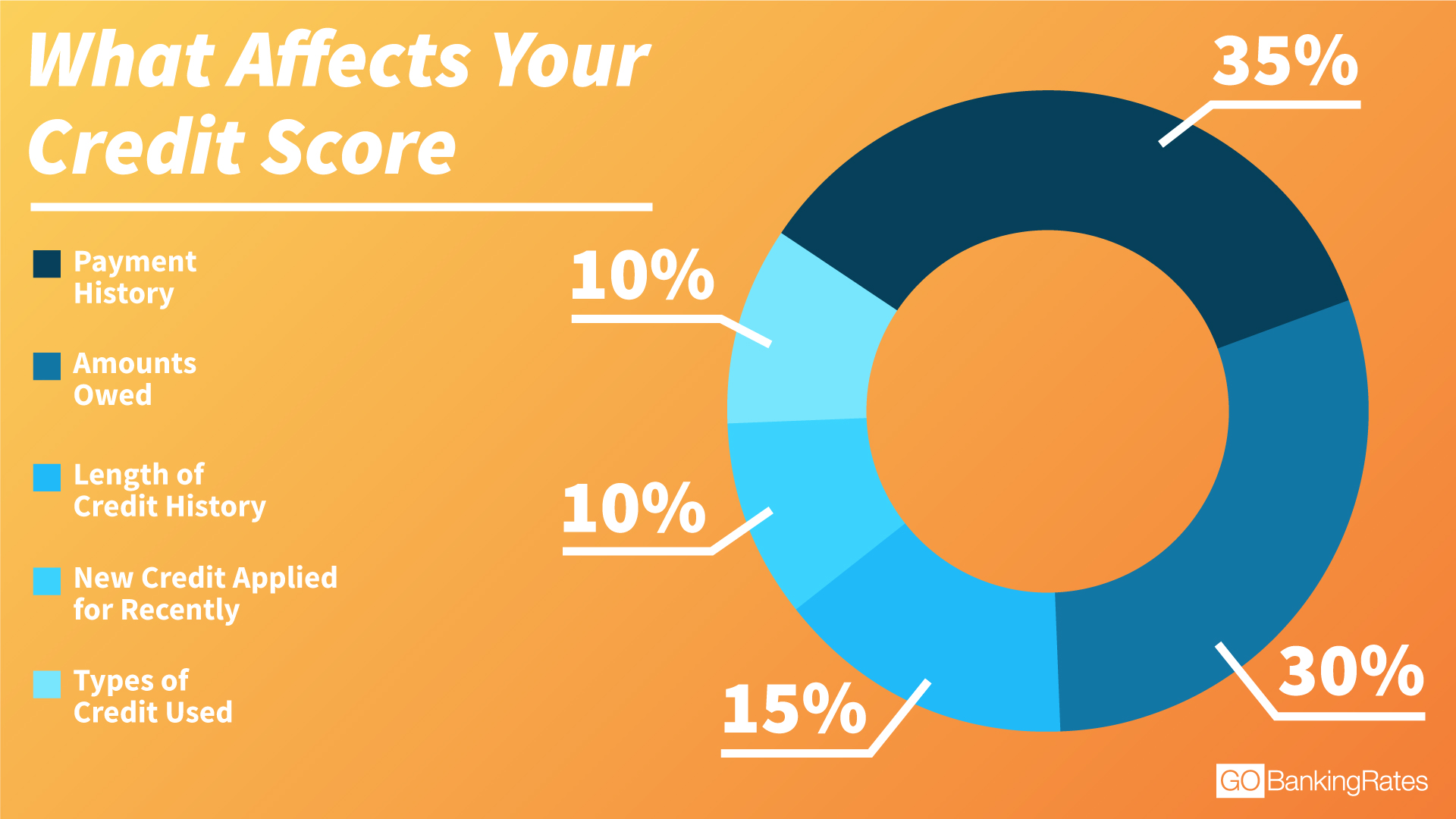

Step #1: Fix Your Credit

If you have a poor credit report, you will not be able to qualify for the credit you need in order to travel the world for free!

Even if you think you have good credit, it is suggested that you check your credit because 90% of people have errors and misinformation on their credit reports, for which you may be paying for someone else's mistakes.

Be sure to check out our free "DIY Credit Repair Kit" because fixing your credit is really simple. However, if you decide you don't want to deal with it and would rather have someone else do it for you, we have provided some great resources of companies that will fix your credit.

Step #2: Lower Your Debt

One of the reasons it is so easy for many credit repair companies to fix your credit is because they use legal loopholes to increase your credit score. However, if there are no or limited legal loopholes they can use, then you may need to eliminate some of your debt to lower the debt you have on your credit.

Now, did you notice what I said? I did not say you have to pay off your debt, which may also be an option too.

We also utilize banking laws that the banks use against you to charge you fees and higher interest. However, we employ these same laws to eliminate your debt by as much as 50%.

Imagine if you had a debt of $250,000 and we could use these laws to lower your debt to $125,000! Just imagine how many years sooner you would be able to retire?

Step #3: Establish Your Credit

If you are young and have never had a credit card or if you are someone who has had to rebuild your life, perhaps after going through a divorce, we suggest that you use a loophole of the rich that we call the "Money Saving Secrets Of The Ultra Rich." This method can help you rebuild your credit in 60-90 days in most cases.

One of the ways we achieve this is by utilizing a network of individuals who have excellent credit. You can leverage their credit to build your own credit. For example, Stephen, who has earned 20 million points, was able to build a credit score that enabled him to obtain $3.2 million dollars in credit.

Most people imagine having $3.2 million dollars in credit as dangerous. And yes, it would be if Stephen were not responsible. However, your credit score is based on the amount of credit you have used.

So, if you only have a $1,000 credit limit but you spend $500 dollars, your credit score will be worse than Stephen's, who has $3.2 million dollars in credit, even if he spends $10,000 on his credit.

You can leverage our network to rebuild your credit in the next 60-90 days.

Step #4 Apply For Credit

Once you have built up some good credit, it is now time to start applying for a credit card to start earning some free vacations. The Chase Sapphire card is the first card suggested for you to go after because Chase only allows you to get 5 cards in a 2-year period.

So, it is suggested that you go after the first 5 credit cards from Chase. However, if you do not qualify for any of the Chase credit cards due to this rule, don't despair because there is another legal loophole you can use in step #5.

We have resources for you where you can conduct your own research and look at reviews of some of the best credit cards for your situation.

Step #5: Business Credit

Entrepreneur magazine has stated that 90% of people are unaware of business credit, and even those who are aware don't know how to obtain it.

Business credit is a separate form of credit that is not linked to your social security number. With business credit, you can begin establishing credit that was previously unattainable just 5 minutes ago.

While Chase imposes a limit of 5 credit cards within a 2-year period, if you establish business credit, you can repeatedly obtain the same credit cards over and over again. This is because the more credit cards you acquire, the more points you will earn, allowing you to enjoy more free vacations.

I personally know individuals who go on vacations every single month due to this strategy. Moreover, there are individuals who are even more aggressive in their approach. For instance, as mentioned earlier in this article, Stephen has taken 170 flights in less than a year, despite there being only 12 months in a year.

Step #6: Vacations Are Tax Deductible

By utilizing the points earned from your credit card, you can enjoy free or nearly free vacations. However, in addition to that, if you follow the following advice, your vacations can become tax deductible.

When you go out for dinner, purchase souvenirs, or visit theme parks, these expenses can be considered tax deductible.

You see, over the past couple of years, Congress has enacted a series of governmental stimulus programs. If you have a job, the government will add $300-$500 per month to your paycheck, as well as provide 20-45% cash back on your regular everyday expenses, including vacations.

Conclusion:

The rich spend less than the poor and middle class on those things they need but hate to pay for so they will have more money for those things that make life really enjoyable like cars, homes, shopping an vacations that we call as the money saving secrets of the ultra rich.

So I want to invite you to watch our free video at ultrarich.alphalifestyleacademy.com where you use these exact same secrets to save hundreds, thousands each and every month.

[adrotate group="1"]

[adrotate group="29"]

[adrotate group="30"]