How to Get Out of Debt!

Introduction

let’s talk about a little something that makes most people break out in a cold sweat: debt. Yeah, that’s right, the dreaded D-word. We’ve all seen those Instagram models living the high life, flashing their Gucci and sipping champagne like it’s tap water. But if you tried to keep up with their extravagant lifestyles without a bankroll the size of Fort Knox, you’d be diving headfirst into a financial Deadpool.

So, you might be wondering, do you want to escape the clutches of debt? Maybe you’re dreaming of snagging that dream house or that sweet ride you’ve had your eye on. Or perhaps you’re just plain sick and tired of feeling like you’re trapped in a straightjacket of debt-induced stress.

Now, let me tell you, there are a bunch of so-called experts out there who’ll tell you to pinch every penny and save your way out of debt. And that’s where I have a bone to pick. Sure, it’s one way to do it, but it’s about as much fun as watching paint dry. I mean, seriously, who wants to follow that millionaire-next-door philosophy? It’s all about hoarding your hard-earned cash, never savoring the sweet nectar of a Starbucks latte, never dining out, and basically living like a monk in the name of early retirement. Snooze-fest!

But here’s the deal, folks. In this little chat, I’m gonna spill the beans on how one of my buddies, a guy I met when he was just a sprightly 28, managed to wipe out a whopping $180,000 worth of credit card and student loan debt. Yep, you heard that right – he pulled off a financial superhero move that would make even me raise an eyebrow.

So, stick around, because we’re about to dive headfirst into the world of debt-busting with a twist of Alpha Lifestyle flair. It’s gonna be a wild ride, my friends, and trust me, it’s gonna be way more fun than counting pennies in a jar. Let’s make debt disappear like it’s a bad guy in a red suit!

Step #1 Reduce Your Expenses

We’re about to dive headfirst into the treacherous waters of getting out of debt, and guess what? It doesn’t have to be all gloom and doom, contrary to what those penny-pinching experts might have you believe. Now, you’re probably thinking, getting out of debt? That sounds like a buzzkill, buddy!” Well, hold that thought, because we’re about to drop some knowledge bombs on you.

So, check it out, before you start thinking that it’s all about living on a diet of ramen noodles and tap water, let me set the record straight. Frugal living isn’t about depriving yourself of the good stuff; it’s about slicing and dicing those expenses that make you cringe but are, unfortunately, a necessary evil.

Now, let’s talk about the big three monsters that gobble up your hard-earned cash: taxes, the relentless interest from your debt, and that sneaky financial loss that you’re entitled to but might not even know about. These villains are the ones we’re going to tackle head-on. And trust me, we’re gonna do it with style.

So, keep your katana blades sharp and your chimichangas hot, ’cause we’re about to embark on a mission to conquer debt like it’s a horde of evil mutants. Stick around, it’s gonna be a wild ride!

Step #2 Organize Your Debt(s)

Alright, listen up, my fellow debt-slayers! It’s time to take a good, hard look at that financial quagmire you’re stuck in – mortgages, car payments, credit card debts, the whole shebang. But don’t sweat it; we’ve got a plan that’s gonna make this debt-busting journey feel like a walk in the park. And yes, we’re bringing the Alpha flavor to the table.

Step 1: Grab your trusty workbook and action plans (check out the link below for those goodies). Inside, you’ll find a nifty worksheet and some handy tools that’ll make this process a breeze. No, seriously, it’s like having a unicorn do your taxes – magical.

Step 2: Start by cataloging all your debts. Write ’em down, make a list, or even get artsy with it – just get those debts out of your head and onto the page.

Step 3: Now, here’s where the magic happens. Take a gander at those debt amounts, and let’s find the one that’s ready to be vanquished first. How do you do that? By focusing on the debt you can eliminate the fastest, and that usually means paying the minimum amount. It’s like spotting the weakest link in a chain and breaking it!

So, there you have it, in true Alpha style – catalog, calculate, and conquer! It’s time to kick debt in the chimichangas and take control of your financial destiny. And remember, we’ve got your back with those handy tools, so go ahead and unleash your inner financial superhero!

Step #3 Focus On The Debt You Can Pay Off The Fastest

Well, well, well, time to slice and dice those debts, my fellow financial daredevils! I’ve got a Aplah approved strategy that’ll have you grinning ear to ear as you conquer your financial foes. So listen up, ’cause we’re about to drop some wisdom from the “How To Get Out Of Bad Debt” book, part of the legendary “Rich Dad Poor Dad” series.

Step 1: Pay the minimum amount on all your debts – except for the one that’s about to feel the heat of your financial fury. Yep, that’s right, pick the debt that you can obliterate in the fewest payments.

Step 2: Now, here’s where the magic happens. You’re gonna unleash your inner superhero and pay MORE than the minimum on that chosen debt. The “How To Get Out Of Bad Debt” book suggests a cool $500, but if your wallet’s feeling a bit shy, throw in as much as you can muster. This should be the one debt that’s ready to tap out the quickest, like a villain who’s had enough.

Step 3: Forget what the experts say about tackling your biggest debt first. That can be a real buzzkill when you realize just how long it takes to defeat that monster. Instead, focus on the debt you can knock out in the least number of payments. It’s all about making those wins pile up like a mountain of chimichangas!

Step 4: Oh, and when that debt falls, take a moment to CELEBRATE! Picture yourself, doing a victory dance with a mariachi band – that’s the level of celebration we’re talking about here.

Step 5: Rinse and repeat, my friends! Move on to the next debt that you can smite in the fewest payments and keep going until you’re riding the debt-free rainbow.

So, there you have it – a debt-crushing strategy that’s as fun as a chimichanga feast and as effective as my ninja-like moves. Get ready to dance all over those debts and unleash your financial awesomeness!

Step #4 Cool Trick To Get Uncle Sam To Pay Your Bills

Hold onto your tacos, folks, ’cause I’ve got a story that’s gonna blow your mind! Picture this: I’ve got a client, a real financial ninja, whose job is to sniff out money hidden in the nooks and crannies of people’s lives – money they didn’t even know existed. Yeah, you heard me right, it’s like a treasure hunt for cold, hard cash that’s just waiting to be unleashed.

For instance, one lucky guy didn’t have a clue he had ten grand chilling in an account somewhere. Talk about a surprise party for your wallet, am I right?

Then there’s this family, and brace yourselves, ’cause this one’s a real shocker – they had an inheritance worth…wait for it…a few MILLION dollars just lying around, collecting dust like a forgotten superhero comic!

Now, I get it, these are some seriously outlandish examples, but here’s the kicker – one of the biggest expenses you’ve got is the money you didn’t even know you lost. Imagine life chugging along, business as usual, and you’re sipping on your morning coffee, blissfully unaware that there’s a pile of moolah just itching to jump into your bank account.

Now, here’s where things get interesting – I’m about to dig into the world of governmental stimulus programs and unearth an extra $500 per month for you. That’s right, we’re gonna tap into some financial Deadpool magic and turn your everyday expenses into a monthly cash bonanza!

So, stay tuned, ’cause we’re about to make your wallet do a happy dance like it’s won the lottery. Who knew finding hidden money could be this exhilarating? It’s time to make it rain

1) FREE Government Money -Oh, strap in, my fellow money-hungry warriors, ’cause we’re about to talk about something that’s gonna make you do a double take – FREE Government Money! Yep, you heard that right. The government’s dishing out billions of dollars every year to regular folks like you and me. It’s like Christmas, but without the ugly sweaters.

So, check it out, there’s this program that could be your ticket to an extra $300-$500, just tacked onto your paycheck. That’s right, it’s like a bonus you didn’t even have to ask for. But wait, there’s more! You can also score some sweet 20-45% cashback on your everyday expenses. That’s like getting paid to shop, and who doesn’t love that?

Now, here’s where the magic happens – you take that extra $300-$500 from your paycheck and the cashback you’re raking in, and guess what? You put it to good use – paying off those pesky debts. It’s like turning government generosity into your very own debt-busting superpower.

So, suit up, my friends, ’cause we’re about to grab that free government cash with both hands and use it to kick debt’s butt. Who said being a financial hero couldn’t be fun? Let’s make that money work for us!

If you are listening to the online version we have provided you the links in the resources section.

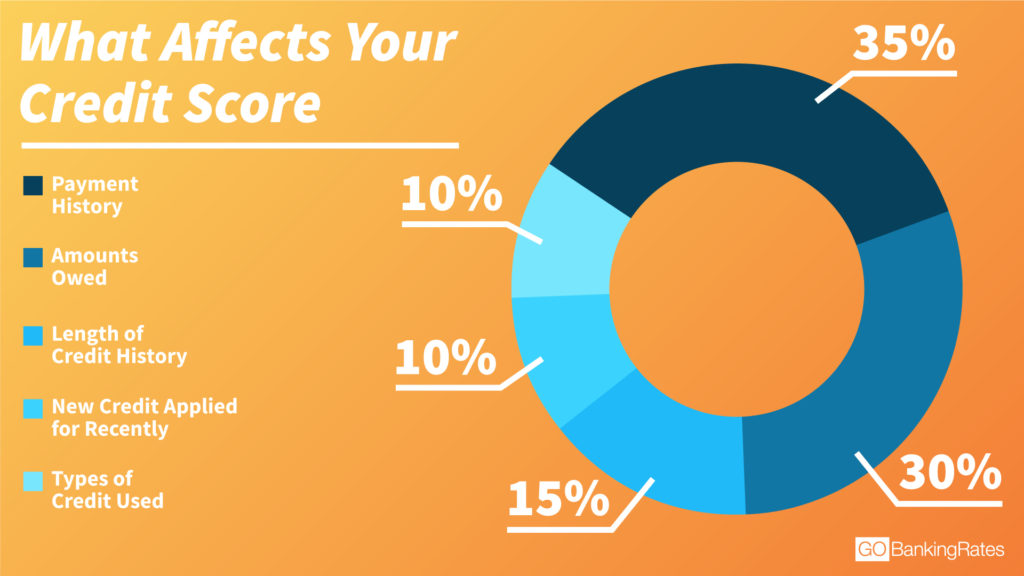

Now, picture this: having bad credit is like walking around with a bullseye on your back, and it’s gonna cost you a pretty penny – 50% more, to be precise – than if you had the golden ticket of good credit.

Let’s break it down with a little scenario, shall we? You stroll into a dealership, all swagger and charm, ready to snag that sweet ride for a cool $15,000. But, hold up, if your credit’s in the gutter, that same car’s gonna set you back a whopping $30,000. Yep, you heard me right, it’s like paying for two cars when you could’ve had one.

So, here’s the deal, my friends – having good credit is like having a golden ticket to the financial amusement park, where everything’s a breeze. But bad credit? Well, that’s like standing in line for the most torturous ride, and you’re gonna pay a hefty price for it.

But don’t worry, we’re not here to scare you straight; we’re here to empower you to fix that credit score and save those hard-earned Benjamins. So, saddle up, ’cause we’re about to transform your credit from zero to hero. It’s time to take control and make sure you’re not paying double for that dream car.

If you are listening to the online version we have provided you the links in the resources section.

3) Eliminate 50% Of Your Debt –

3) Eliminate 50% Of Your Debt –

Hold onto your chimichangas, because we’re about to dive into some serious money-saving secrets! You see, there are these pesky laws that the banks love to use against you, racking up high fees and making you shell out more cash because, well, they’re counting on you not knowing any better.

But guess what? You can turn the tables on those sneaky banks and give ’em a taste of their own medicine. That’s right, it’s like flipping the script and using the money-saving secrets of the ultra-rich to take a big ol’ bite out of your debt.

How much, you ask? How about slashing up to 50% of that debt monster! Imagine that, shedding half of your financial burden like a snake shedding its skin.

So, gear up, my fellow financial daredevils, ’cause we’re about to learn how to use those laws to our advantage and show those banks who’s boss. It’s time to unleash your inner money-savvy superhero and make that debt disappear like it owes you money – which, in a way, it does!

If you are listening to the online version we have provided you the links in the resources section.

4) It Takes Money To Make Money –

4) It Takes Money To Make Money –

Ah, my fellow financial adventurers, we’ve been on quite the ride learning how to escape the clutches of debt. But hold onto your chimichangas because here’s a nugget of wisdom you can take to the bank: “It takes money to make money.”

I can hear you now, saying, “Wait, I barely have enough money as it is, and this sounds like a frustrating cycle with no light at the end of the tunnel.” Well, don’t worry, we’ve got your back. We’ve already shared some sneaky tricks to cut those expenses and even unearthed some hidden freebies you didn’t know existed.

Now, let’s talk about debt, my friends – there are two kinds. First, there’s the bad debt, the kind that’s like an anchor dragging you down. Think credit card bills and car payments; these are what we call expenses, and most of you are probably stuck in this quagmire.

But then, there’s the good debt – yeah, you heard me right, good debt. This is the kind of debt that puts money back in your pocket. Let me tell you about one of my mentors, the guy had a hefty $90,000 in student loans and another $90,000 in credit card debt, a grand total of $180,000 in debt.

But here’s where things get interesting – he went even deeper into debt by investing $8,000 in an income opportunity, and guess what? In just 30 days, that investment churned out a cool $10,000.

Now, why am I telling you this? Because that good debt, the kind that pays you, was used to slay the bad debt dragon. It’s like a sword that slices through your financial enemies.

You see, the rich aren’t working themselves to the bone; they’re putting their money to work for them. Instead of burning the midnight oil, they’re investing their hard-earned cash in various opportunities, letting it do the heavy lifting.

So there you have it, folks – a lesson straight from the financial playbook of the rich. It’s time to let your money do the talking and make your fortune work for you by visiting http://businesscapital.alphalifestyleacademy.com Let’s unleash the power of good debt and make some serious financial waves!

If you are listening to the online version we have provided you the links in the resources section.