Why Are The One Percenters Moving To Florida?

It’s not about how much money you make but, how much money you keep. Billionaires and millionaires are leaving places like New York, and California because of the high taxes to the sunny state of Florida.

Hedge fund billionaires have relocated to Florida for tax reasons for years — David Tepper, Paul Tudor Jones and Eddie Lampert being among the most prominent.

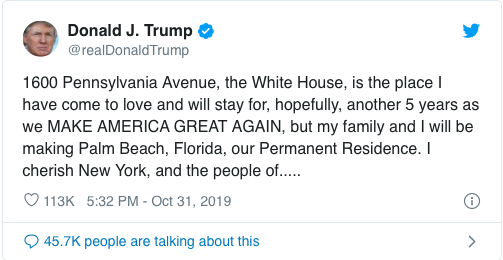

Last week, the New York Times reported that Donald Trump had submitted paperwork to change his residency from New York to Florida. The President confirmed the news in a series of tweets, at first a little wistful (“I cherish New York, and the people of New York, and always will.”), followed by a familiar chaser of vitriol for one of his political rivals (“New York can never be great again under the current leadership of Governor Andrew Cuomo.”).

The move has many potential implications for the 73-year-old Queens native. Town & Country asked Lee-ford Tritt, a law professor and member of the graduate tax faculty at the University of Florida College of Law, to walk us through how the move might affect the President’s bottom line.

Carl Icahn Moves To Florida

Billionaire Carl Icahn is planning to move his home and business to Florida to avoid New York’s higher taxes, according to https://www.bloomberg.com/news/articles/2019-09-12/carl-icahn-is-said-to-be-heading-to-florida-for-lower-tax-rates

Icahn, 83, who was born in the Far Rockaway neighborhood in Queens, New York, has been an icon on Wall Street for decades. In the 1990s, he bought a mansion in the exclusive Indian Creek island enclave on Biscayne Bay in Miami.

The move is scheduled for March 31 and employees who don’t do so won’t have a job, said the people, who asked not to be identified because the matter was private.

Hedge fund billionaires have relocated to Florida for tax reasons for years — David Tepper, Paul Tudor Jones and Eddie Lampert being among the most prominent. But Florida officials have been aggressively pushing Miami as a destination for money managers since the Republican-led tax overhaul. Signed by President Donald Trump in 2017, it set a $10,000 cap for state and local tax deductions, including income and real estate taxes.

Florida Nabs Money Managers as Property Tax Cap Boosts Pitch

As the tax bill was being negotiated, then Florida Governor Rick Scott, a former resident of Greenwich, Connecticut, made trips up north to court investment firms.

Florida is one of seven states without a personal income tax, while New York’s top rate is 8.82%. Florida’s corporate tax rate is 5.5%, compared with 6.5% in New York. Icahn’s move was reported earlier by the New York Post.

The difference could mean dramatic savings for Icahn, who is the world’s 47th richest person with a personal wealth of $20.4 billion, according to the Bloomberg Billionaires Index.

His investment vehicle, Icahn Enterprises LP, has a market value of $13.6 billion and reported adjusted earnings before interest, taxes, depreciation, and amortization of $1.6 billion in 2018, according to data compiled by Bloomberg.

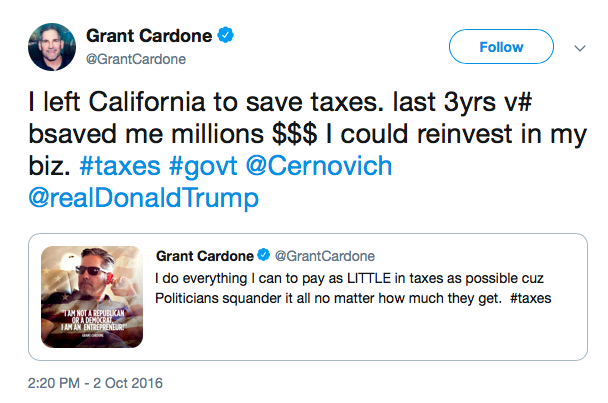

Grant Cardone Left Los Angeles For Miami

Grant Cardone is known as a sales and real estate and currently has a $1.2 Billion dollar real estate empire known as Cardone Capital and flies around in his $80 million dollar jet.

Why Would Someone Leave New York For Florida?

“The tax implications will be huge for President Trump. He lives in Manhattan and is therefore subject to New York city tax and New York state tax. Florida does not have an income tax so he’ll probably save about 12 percent a year in taxes. Florida also does not have an estate tax which is huge because the estate tax in New York is about 16 percent for any amount over $5,750,000. So, between income tax and estate tax, he and his heirs are going to be saving a lot of money.”

How Do You Do It?

“New York and other states with income taxes do not like to give up revenue and that’s where the statutory residence test comes in. New York State checks to see if you spent more than 183 days in New York after your move. It will literally check if you had flights that connected through LaGuardia or JFK and count those as days. And if you spend 183 days and one hour in the state, New York considers you a resident.”

States go much farther than just checking flight records. Last spring, a court decided that a man did not qualify as a Florida resident after a lawyer produced evidence that he checked into his gym in California on 300 days in the year he was supposedly living in Florida. States also assess where individuals with multiple dwellings keep their art collections and other prized possessions—the so-called Teddy Bear Test—and use that information to make judgments on residency.

There Must Be Ways To Prove I Actually Moved

“In the old days, we would tell clients to write down where they were every day of the year in a print calendar so they could prove to investigators that they spent the majority of their time in their new domicile. Nowadays, you tell your clients to keep track of it on their smartphones.”

Monaco and TaxBird are two residency tracking apps that automatically record users’ whereabouts and give early warnings if they get close to the maximum number of allowable days.

Okay. I Can Do 183 Days. Anything Else?

“It’s a good idea to give up your country club membership and other affiliations in your old home state and join ones in your new one. But that’s complicated for wealthy people who own multiple homes and belong to numerous clubs. It might be even more complicated for President Trump because he owns country clubs.”

My Accountant Already Makes Sure I Don’t Pay A Lot Of Taxes. Any Other Reasons To Go?

“Florida has something called Homestead Protection, which prevents you from being forced to sell your home to pay certain creditors.” (OJ Simpson, for example, was able to keep his Florida home after being ordered to pay $25 million in wrongful death judgment in a lawsuit filed by the families of Nicole Brown Simpson and Ronald Goldman.) “There’s no monetary limit, so depending on how expensive that house is, you can save a lot of your money from bankruptcy or credit claims.” (Nowadays people looking to avoid potential creditors can also enlist legal advisors to set up offshore or domestic “asset protection trusts.”)

Only In Florida?

“Hardly, there’s no income tax in Texas as well and it has similar home protection laws. It really comes down to personal taste. Are you a Florida type or is Texas your style?” Alaska, Nevada, South Dakota, Washington and Wyoming are five states that also do not levy a personal income tax.

Is It Bad For Florida?

“In high-profile cases like this, people always say, ‘This seems so outrageous!’ but it is a very common move for wealthy and for older people. It’s old-school financial planning. People in my field would yawn if you mentioned it. Or say, ‘I’m surprised he hadn’t done it sooner.’ Florida is able to generate revenue from tourism. And having wealthy people move to the state brings money to its service industries.”

See the original article: https://www.townandcountrymag.com/society/money-and-power/a29715214/donal-trump-florida-wealthy-people-tax-breaks/

7 thoughts on “Why Are The One Percenters Moving To Florida?”

Comments are closed.