Make 3 Million Dollars From A $250,000 Property

[adrotate group="1"]

[adrotate group="29"]

[adrotate group="30"]

Before we look at how this agent pulled out $3 million dollars from a $250,000 property we need to understand what your competition is doing because just as Sun Tzu said “If you know the enemy and know yourself, you need not fear the result of a hundred battles. If you know yourself but not the enemy, for every victory gained you will also suffer a defeat. If you know neither the enemy nor yourself, you will succumb in every battle.”

The competition is fierce! But for you to succeed, you have to know what you are up against because as Marc Cuban said: “IF YOU DON'T KNOW MORE THAN YOUR COMPETITION, THEY CAN KICK YOUR ASS”.

People have gotten number to the way that most enterprises do business because almost everyone is doing the same thing just under a different company or different brand name. So most people have gotten numb to the way that most enterprises do business and can ignore you.

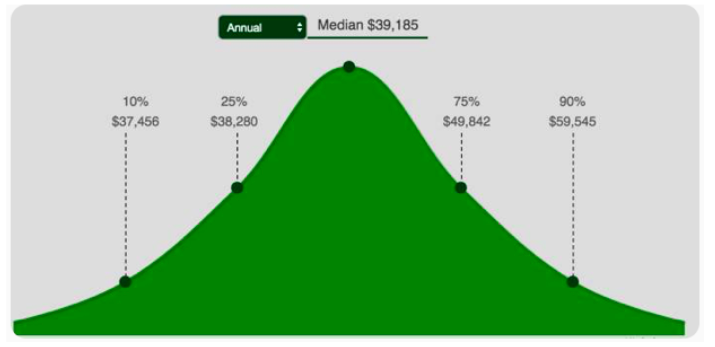

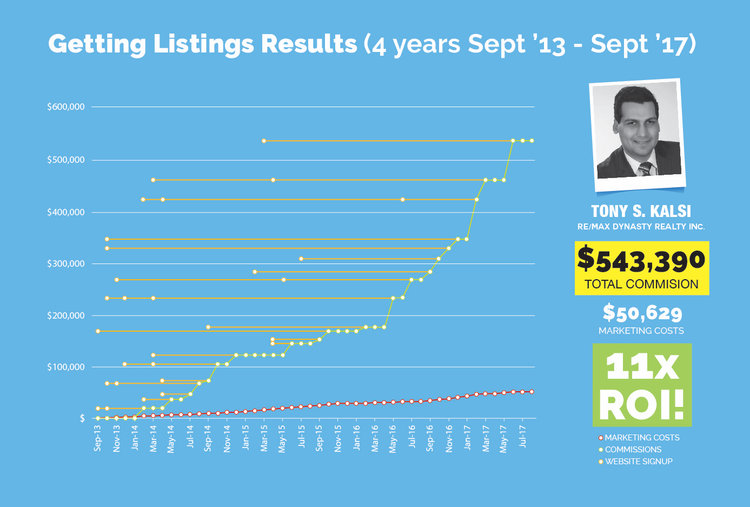

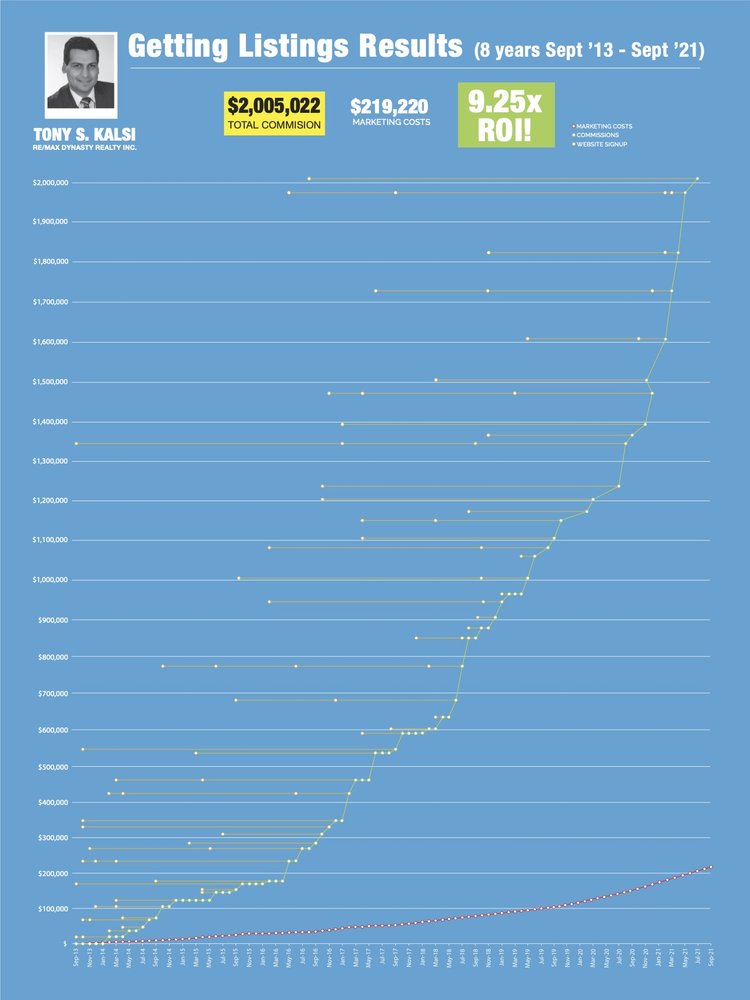

Research shows the average real estate agent makes $40,000 a year and 90% earn less than $60,000 a year, and according to data published at https://www.tomferry.com/blog/87-of-all-agents-fail-in-real-estate/ which shows that 87% of licensed real estate agents fail.

This isn't meant to scare you but give you hope because once you see how easy it is to once you have the proper knowledge. A general never goes into a battle without knowing what he is up against however, most go into business with nieve optimism.

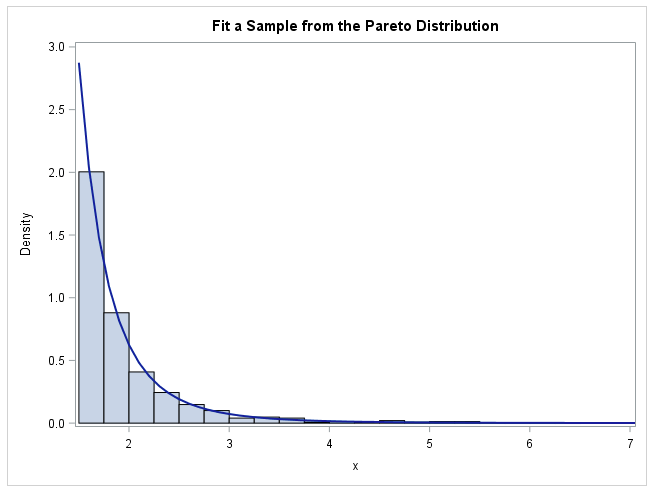

You may be familiar with Vilfredo Pareto and De Solla Price from school also known as the 80/20 law and prices law.

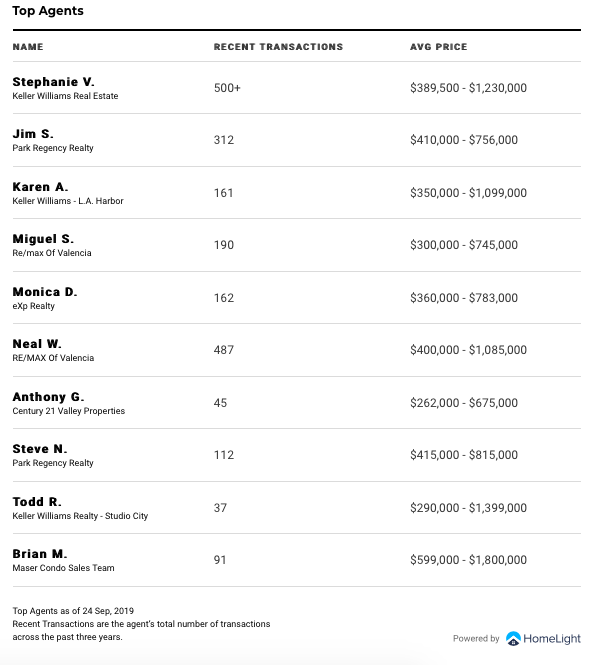

In this example were looking at real estate but don’t be distracted by the industry were looking at because the principle crosses over into any industry including real estate which the square root produces 50% of the results. If you have 10,000 real estate agents, 100 produce half of the results.

(see Los Angeles top 10 real estate agents) Los Angeles’s #1 agent sold a minimum of 188 more properties than anyone else in the top 10 however, Los Angeles #1 agent, they do not give an exact number. We just know they sold over 500+ homes and for a higher price than anyone else in the top 10)